In today’s volatile business landscape, proactive risk management and crisis planning are essential for sustaining success. Savvy leaders recognize that identifying and mitigating risks, as well as preparing for potential crises, should be integral to their business strategies. This article delves into the creation of a comprehensive risk management framework, the development of contingency plans, and the establishment of protocols to minimize business disruptions.

Creating a Risk Management Framework

A robust risk management process involves several critical steps:

- Identifying Risks: Begin by compiling an inventory of potential threats, both internal and external, such as operational risks (e.g., supply chain disruptions), financial risks (e.g., cash flow shortfalls), strategic risks (e.g., shifts in consumer preferences), compliance risks (e.g., data breaches), human resource risks (e.g., loss of key staff), and external risks (e.g., natural disasters).

- Analyzing Risks: Assess the likelihood of each identified risk materializing by utilizing data and research. Additionally, estimate the potential impact of these risks.

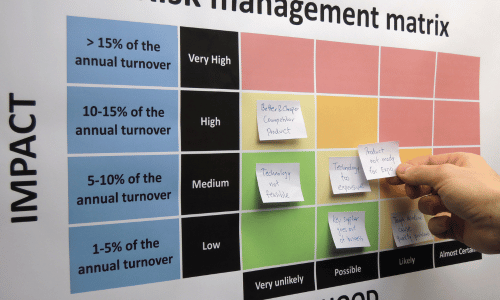

- Prioritizing Risks: Map the identified risks based on their severity of impact and probability of occurrence. Place the most significant focus on addressing major threats that are likely to materialize.

- Mitigating Risks: Develop tactics to either prevent the identified risks from occurring or minimize their impact if they do materialize. This proactive approach involves addressing root causes and vulnerabilities.

- Monitoring Risks: Continuously track leading indicators that may signal the emergence of new risks. Regularly re-evaluate the risk landscape and update mitigation plans accordingly.

- Reporting Risks: Keep the leadership team and the board informed about the most significant risks and the progress made in reducing the organization’s exposure to these risks.

Proactive risk management serves to reduce strategic surprises and safeguard the value of the organization.

Developing Crisis Management Plans

Even with robust risk management practices in place, crises can and will occur. To minimize disruption, detailed crisis management plans should be developed:

- Assemble a Crisis Management Team: Designate key executives and advisors who will play central roles in decision-making during crises. Clearly define their roles and responsibilities.

- Identify Crisis Scenarios: Brainstorm potential crises that could be tied to your business’s vulnerabilities. These scenarios may include product recalls, leadership scandals, or cyberattacks.

- Outline Response Protocol: Document clear procedures for crisis response, including notification processes, decision-making authorities, internal and external communication workflows, and the criteria for activating the crisis plan. Appoint backup personnel for critical roles.

- Enable Rapid Response: Establish 24/7 access protocols and dedicated facilities (war rooms) to convene the crisis management team quickly during emergencies.

- Maintain Updated Contacts: Compile detailed contact information for team members, regulatory authorities, law enforcement agencies, technical support, public relations advisors, and other key stakeholders.

- Provide Tools: Equip the crisis management team with necessary resources, such as emergency hotlines, backup IT infrastructure, prepared media statements, and employee communication templates.

- Train Regularly: Conduct tabletop simulations and crisis drills to test the effectiveness of the crisis plan and ensure that the team is prepared to respond to a range of crisis scenarios. Identify areas for process improvement.

- Audit Plans: Review and update crisis plans at least every six months to ensure that the information and procedures remain current as threats evolve.

Effective crisis readiness reduces response times, helps manage public messaging, and maintains a focus on business continuity during times of turmoil.

Executing Crisis Communications

Effective crisis communication is crucial for minimizing reputational damage:

- Respond Quickly: Act swiftly by issuing an official statement that acknowledges the crisis situation. Delay or silence can erode trust.

- Show Concern: Express empathy, compassion, and reassurances to all affected parties. Prioritize support for customers and staff.

- Share Key Facts: Provide accurate and transparent information about the crisis, including its causes, the organization’s response efforts, and the impacts as they are known. Avoid speculating and correct misinformation.

- Disclose Next Steps: Communicate the specific actions being taken to control the crisis, along with expected timeframes. Outline contingency plans for further reassurance.

- Leverage Channels: Distribute crisis messages through various channels, including websites, social media, press releases, notifications, and direct communication with customers and employees.

- Choose the Proper Tone: Strike a balance between confidence and compassion. Avoid adopting a defensive stance.

- Own Mistakes: If the organization’s actions contributed to the crisis, take responsibility, apologize, and explain the steps being taken to rectify the situation and prevent its recurrence.

- Engage with Media: Proactively contact media outlets directly with statements to ensure that your organization has an active role in shaping the narrative. Offer interviews selectively and cautiously.

- Update Stakeholders: Keep key audiences informed with new information as the situation evolves. Timely updates help maintain trust and credibility.

- Assess Performance: After the crisis subsides, conduct a comprehensive review of the effectiveness of your crisis preparations, communications, and response efforts. Seek external feedback to gauge public perceptions and identify areas for improvement.

Transparent, decisive crisis communications help limit chaos and reassure stakeholders.

Key Takeaways

- Make risk management and crisis readiness ongoing priorities rather than treating them as one-off activities. These processes require constant attention.

- Involve cross-disciplinary teams throughout the organization to gain a holistic view of interrelated threats and vulnerabilities. Leverage different perspectives.

- Strike a balance between prudent planning and proper urgency. Avoid getting bogged down in analysis paralysis, but also steer clear of reckless decisions during crises.

- Consider worst-case scenarios without assuming that they will occur. Scenario planning for tail risks is essential.

- With robust risk assessment, contingency plans, and effective communications, organizations can navigate adversity decisively and responsibly. Don’t wait for misfortune to strike – proactive readiness is far wiser.

In conclusion, proactive risk management and crisis planning are critical for any organization operating in today’s unpredictable environment. By systematically identifying, assessing, and mitigating risks, as well as developing comprehensive crisis management plans, businesses can better safeguard their operations and reputation. Furthermore, transparent and empathetic crisis communications can help minimize reputational damage and maintain stakeholder trust.

We’ve unpacked a lot today at Biz Step Ladder, and now it’s your turn to add to the dialogue. Do you have insights or experiences that could expand on what we’ve discussed? Perhaps you’ve identified an angle we haven’t covered. Jump into the conversation below with your comments and let’s continue the learning journey together. Your input is not just welcome—it’s a vital part of our community’s growth. So, what are your thoughts? Share them below and let’s enrich our business wisdom collectively!

Discover related content by exploring Starting a business, common pitfalls, and resources for new entrepreneurs.